Suggestion on clause 46 a of finance bill 2017 section 115jaa extension of period of carry forward of mat credit from 10 years to 15 years clarity regarding carry forward and set off of mat credit in cases where the ten year period has expired on or before ay 2016 17 but the fifteen year period has still not expired.

Mat credit entitlement period.

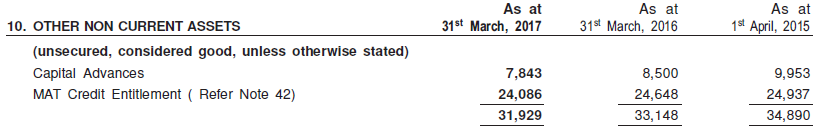

If this circumstance does not arise and mat credit stays in the loans and advances column of the company s balance sheet till the end of the specified period after which it is simply written off.

The asset may be reflected as mat credit entitlement.

This is with effect from ay 2018 19 prior to which mat could be carried forward only for a period of 10 ays.

In the assessment year when regular tax becomes payable the difference between the regular.

Providing relief to assessees paying minimum alternate tax mat finance minister arun jaitley proposed to enhance the time limit to claim mat credit from the existing 10 years to 15 years.

Such tax credit shall be carried forward for 15 assessment years immediately succeeding the assessment year in which such credit has become allowable.

In the year of set off of credit the amount of credit availed should be shown as deduction from the provision of taxation on the liabilities side of the balance sheet.

Tax experts welcomed the move to reduce the corporate tax reduction to 25 per cent for msmes with turnover up to rs 50 crore.

Rs 14 43 000 rs 12 48 000 rs 1 95 000.

Unabsorbed mat credit will be allowed to be accumulated subject to the 10 years carry forward limit.

They do so by showing the mat credit as mat credit entitlement to the credit of the income and expenditure amount.

The unavailed amount of mat credit entitlement if any should continue to be presented under the head loans advances.